PVPN Trends

Stay updated with the latest trends in privacy and security.

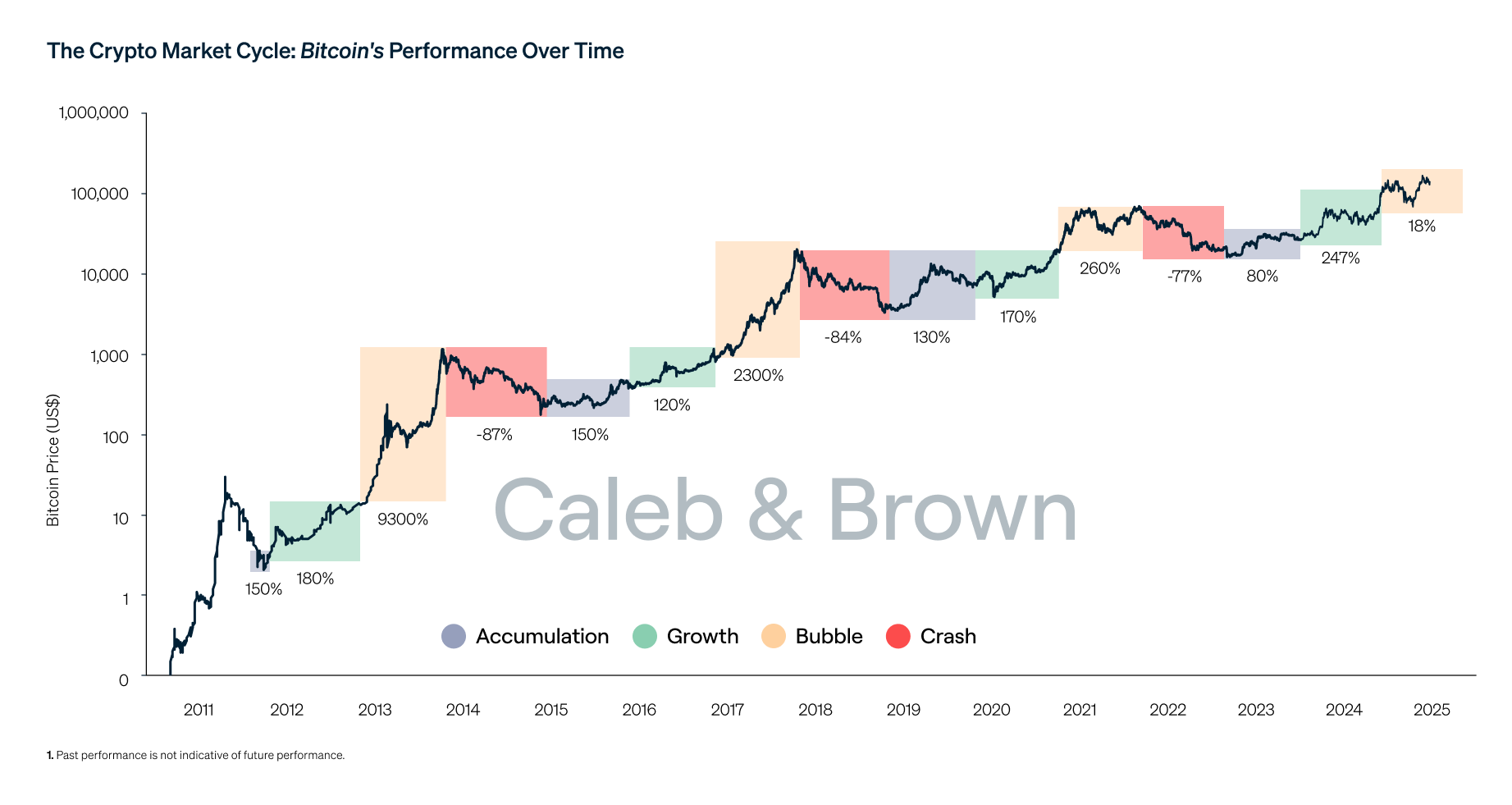

Crypto Whirlwind: How Market Volatility Shapes Investment Strategies

Navigate the crypto storm! Discover how market volatility can turbocharge your investment strategies and boost your profits. Dive in now!

Understanding Crypto Volatility: Key Metrics Every Investor Should Know

Understanding crypto volatility is crucial for any investor looking to navigate the ever-changing landscape of digital currencies. Unlike traditional financial markets, cryptocurrency prices can swing dramatically in short timeframes, influenced by a myriad of factors including market sentiment, regulatory news, and technological advancements. To effectively assess this volatility, investors should become familiar with key metrics such as historical volatility, which measures past price fluctuations, and implied volatility, which reflects market expectations for future fluctuations. Together, these metrics provide a comprehensive view of potential price movements.

Another essential aspect is the beta coefficient, which compares the volatility of a specific cryptocurrency to the overall market. This allows investors to gauge how sensitive an asset is to market movements, helping them make more informed decisions. Furthermore, understanding the average true range (ATR) can help investors assess the degree of price change over a set period, offering insights into potential entry and exit points. By mastering these key metrics, investors can better position themselves to capitalize on opportunities while mitigating risks associated with crypto volatility.

Counter-Strike is a highly competitive first-person shooter that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players must employ strategy, teamwork, and skill to secure victory, making it one of the most popular eSports titles. For those looking to enhance their gaming experience, be sure to check out the cloudbet promo code for some exciting bonuses.

Strategies for Navigating Cryptocurrency Market Swings: A Comprehensive Guide

Navigating the unpredictable terrain of the cryptocurrency market can be challenging, especially for new investors. To effectively manage and mitigate risks associated with market swings, it’s essential to adopt a strategic approach. One of the most vital strategies is to maintain a diversified portfolio. By spreading investments across various cryptocurrencies, you can reduce the impact of any single asset's volatility on your overall portfolio. Additionally, utilizing dollar-cost averaging, where you invest a fixed amount at regular intervals, can help smooth out the effects of price fluctuations, allowing you to buy more when prices are low and less when they are high.

Another critical strategy is to stay informed about market trends and news that can influence cryptocurrency prices. Technical analysis can be a handy tool, providing insights into market movements through historical price charts and volume data. Consider setting up price alerts to keep track of significant changes and establish clear entry and exit points based on your research and risk tolerance. Lastly, cultivating a disciplined mindset is key; avoid making impulsive decisions driven by fear or hype, and stick to your predefined strategy for navigating the volatile crypto landscape.

Why Do Cryptocurrencies Experience Such Extreme Fluctuations?

The world of cryptocurrencies is often characterized by its notorious price volatility. This extreme fluctuation can be attributed to several interrelated factors. Firstly, the market for cryptocurrencies is relatively young and less mature compared to traditional markets, leading to lower liquidity and higher susceptibility to large price swings. Additionally, the influence of social media and news cycles can cause drastic shifts in sentiment. For instance, a single tweet from a prominent figure can lead to a surge in buying or selling, demonstrating how quickly crypto prices can change in reaction to external stimuli.

Moreover, the speculation surrounding cryptocurrency investments plays a significant role in driving price movements. Investors often react to market trends and rumors, amplifying fluctuations through buy or sell actions based on perceived opportunities or fears. Regulatory developments and technological innovations also contribute to this volatility, as changes in regulations or the introduction of new features can radically alter market dynamics. Understanding these factors is crucial for anyone looking to navigate the unpredictable landscape of cryptocurrencies.