PVPN Trends

Stay updated with the latest trends in privacy and security.

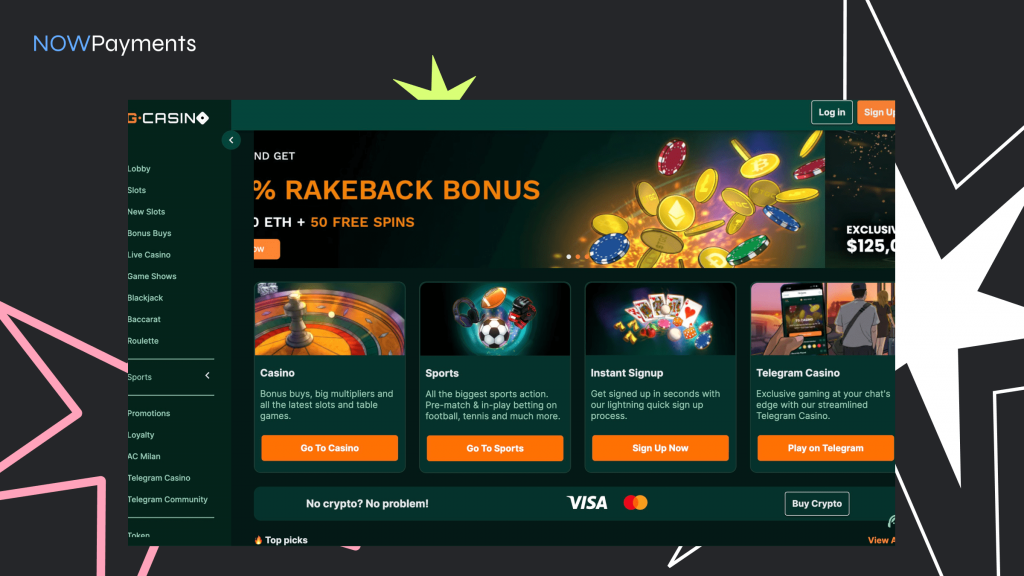

Betting Big on Crypto Items: Models That Redefine Risk and Reward

Discover bold strategies to navigate crypto investments! Uncover models that redefine risk and reward in the world of digital assets.

Understanding the Risk-Reward Spectrum in Crypto Betting

The world of crypto betting presents a unique risk-reward spectrum that is crucial for participants to understand. Unlike traditional betting, where outcomes are primarily influenced by chance, crypto betting introduces the volatility of cryptocurrencies, adding another layer of risk. Investors must evaluate not only the likelihood of winning a bet but also the potential implications of fluctuating digital asset prices. As such, gaining a comprehensive understanding of this spectrum can be the key to making informed decisions, ultimately leading to successful betting strategies.

To navigate this landscape, bettors should assess their risk appetite and tailor their strategies accordingly. An effective approach often involves diversifying bets across various crypto assets, which can help mitigate risks associated with price volatility. Additionally, it's essential to stay informed about market trends and analyze historical data to identify potential opportunities. By doing so, bettors can better position themselves to capitalize on favorable odds while managing their exposure to risk, thereby enhancing their overall betting experience.

Counter-Strike is a popular first-person shooter franchise that pits teams of terrorists against counter-terrorists in various game modes. Players can engage in intense matches where strategy and teamwork are crucial for victory. For those looking to enhance their gaming experience, using a csgoroll promo code can provide exciting bonuses and rewards.

Top Models to Evaluate Risk in Crypto Gambling

In the ever-evolving landscape of cryptocurrency, it's essential to implement robust models to evaluate risk in crypto gambling. Traditional risk assessment frameworks often fall short in addressing the unique challenges posed by cryptocurrencies. One prominent model is the Value at Risk (VaR), which quantifies the potential loss in an investment portfolio over a defined period for a given confidence interval. By utilizing VaR, operators can determine the likelihood of significant losses in their gambling ventures and make informed decisions about fund allocation and risk management strategies.

Another crucial model is the Monte Carlo Simulation, which allows stakeholders to assess various scenarios of crypto gambling outcomes and their associated risks. This model utilizes random sampling to simulate and predict the potential risks and returns over time. By analyzing a range of possible outcomes, operators can identify patterns and make proactive adjustments to their strategies, significantly enhancing their decision-making process in a highly volatile market.

Is Betting on Crypto Items Worth the Risk? Insights and Analysis

As the digital landscape evolves, betting on crypto items has emerged as a controversial yet intriguing option for gamers and investors alike. The appeal lies in the potential for high returns, as the value of crypto items can fluctuate dramatically based on market demand and trends. However, caution is warranted; the volatility of cryptocurrencies paired with the nascent nature of the gaming and betting industry can lead to significant risks. Hence, it's crucial to weigh the potential benefits against the possible downsides before diving in.

Investors should consider several factors in their decision-making process. Market research is essential—understanding the specific crypto item, its market behavior, and the platform it's offered on can provide valuable insights. Additionally, factors like regulatory changes and technological advancements can impact the landscape dramatically. It's advisable to adopt a diversified approach, engage in responsible gambling practices, and only invest what one can afford to lose. By doing so, bettors can better navigate the complexities of betting on crypto items and make informed decisions.