PVPN Trends

Stay updated with the latest trends in privacy and security.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover why term life insurance is the essential safety net you never knew you needed—protect your loved ones and gain peace of mind today!

Understanding Term Life Insurance: How It Protects Your Loved Ones

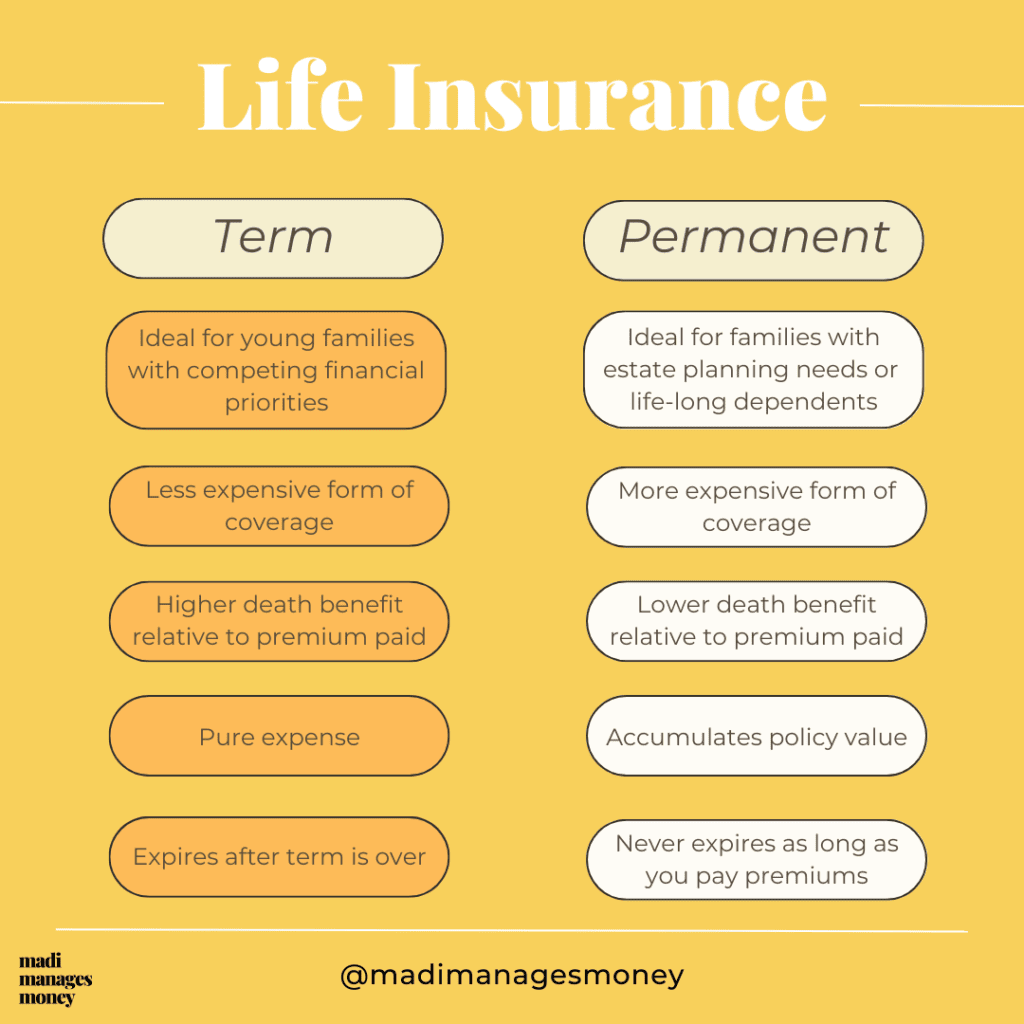

Understanding Term Life Insurance is essential for anyone looking to secure their loved ones' financial future. This type of insurance is designed to provide a death benefit to your beneficiaries if you pass away during the policy term, typically ranging from 10 to 30 years. By choosing a term life policy, you can ensure that in the event of your untimely death, your family will receive a lump sum payment that can help cover expenses such as mortgage payments, education costs, and daily living expenses, allowing them to maintain their standard of living.

Term life insurance is often more affordable than other forms of life insurance, such as whole life or universal life policies, making it an attractive option for many families. Additionally, it offers a simple structure without the complexities of investment components found in permanent insurance products. With the peace of mind that comes from knowing your loved ones will be financially protected, you can focus on building memories together rather than worrying about potential future uncertainties.

Is Term Life Insurance Right for You? Key Considerations to Keep in Mind

When considering whether term life insurance is the right choice for you, it is essential to evaluate your financial obligations and family situation. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. This type of policy can offer a significant death benefit that can help support your loved ones in the event of your passing, covering expenses such as mortgages, education, and daily living costs. Assessing your current and future financial needs will help you determine if the coverage offered by term life insurance aligns with your requirements.

Another key consideration when deciding on term life insurance is your overall health and age. Premiums are generally lower for younger, healthier individuals, making it a wise choice to lock in a policy early. However, if you anticipate changes in your health or family status, it may impact your decision. Additionally, consider the possibility of converting your term policy to a permanent policy in the future, should your needs evolve. Weigh these factors carefully to ensure you choose the most suitable option for your long-term financial security.

Top 5 Benefits of Term Life Insurance You Might Not Be Aware Of

Term life insurance offers more than just financial protection for your loved ones. Here are five benefits that you might not be aware of:

- Affordability: One of the most significant advantages of term life insurance is its cost-effectiveness. Compared to whole life policies, term life premiums are generally much lower, making it an accessible option for many families.

- Flexible Coverage Options: Term life insurance allows you to choose the coverage duration that best fits your needs, whether it's 10, 20, or even 30 years. This flexibility means you can match your policy term to your financial obligations, such as a mortgage or your children's education.

3. Convertibility: Many term life policies come with the option to convert to a permanent insurance policy without undergoing a medical exam. This feature can be a safety net if your health changes later in life.

4. Peace of Mind: Knowing that your family will be financially secure if something happens to you can relieve a significant burden. Term life insurance can ensure that your loved ones are taken care of during critical periods, such as raising children or paying off debts.

5. Tax Benefits: The benefits paid out from a term life insurance policy are generally tax-free. This aspect ensures that your beneficiaries receive the full amount without worrying about tax implications.